Due to the exceptional circumstances of 2020 related to the COVID-19 pandemic, the legislator, in addition to the tax deductions currently in force, such as relief for raising children, Internet deduction, deductions of payments to the Individual Retirement Security Account (IKZE), rehabilitation relief or deduction of donations made to for public benefit organizations, for the purposes of religious worship or donations made by honorary blood donors, he provided for new concessions and exemptions related to COVID-19.

Donation for the fight against COVID-19

Taxpayers may deduct from the tax base for 2020 donations (in cash or in kind) for purposes related to counteracting COVID-19 provided from January 1, 2020 to September 30, 2020 to entities performing medical activities, the Material Reserves Agency, the Central Base Sanitary and Anti-epidemic Reserves.

Importantly, the amount to be deducted was differentiated depending on the moment of donation. In the case of donations made by the end of April 2020 and in the period from October 1 to December 31, 2020, we can deduct 200% of the donation value from the income. For donations made in May 2020 and in the period from January 1 to March 31, 2021, we can deduct 150% of the donation value. Donations made between June 1, 2020 and September 30, 2020 and between April 1, 2021 and the end of the month in which the COVID-19 epidemic was canceled, are deductible for the amount of the donation.

It is worth remembering that in order to make a deduction on this account, the taxpayer must have a proof of payment to the recipient’s payment account, or his bank account, other than the payment account in the case of a cash donation, proof of the donor’s identification data and the value of the donation, together with a declaration of the recipient about its acceptance - in the case of a non - monetary donation.

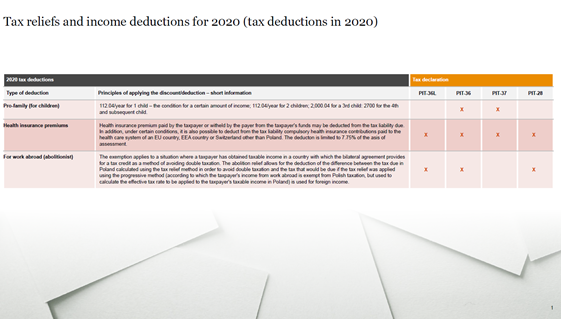

Selected tax deductions in 2020 (click on the picture to enlarge)

Tax loss

Another new deduction that the legislator provided for in connection with the mitigation of the effects of the pandemic is the possibility of settling the loss for 2020. Taxpayers who, due to COVID-19, suffered a loss from non-agricultural economic activity in 2020 and obtained in 2020 total revenues from non-agricultural economic activity lower by at least 50% than the total revenues obtained in 2019 from this activity may reduce one-off the amount of this loss, but no more than 5 000 000 PLN, respectively, income or revenue obtained in 2019 from non-agricultural business activities.

The total revenues for taxpayers of personal income tax is understood as the sum of revenues taken into account when calculating the tax on the basis of art. 27 para. 1 (general principles) and art. 30c (uniform tax) of the Personal Income Tax Act and a lump sum on recorded revenues.

In order to make this reduction, the taxpayer will submit a correction to the tax return for 2019. A loss that will not be deducted in the above-mentioned manner may be deducted under the current general rules.

R&D and IP Box

The legislator also provides for the possibility of deducting eligible costs for R&D activities (and the application of the 5% tax rate (IP Box) in connection with counteracting COVID-19.

Eligible costs incurred in 2020 for research and development, the purpose of which is to develop products necessary to counteract COVID-19, may be deducted by the taxpayer from the income which is the basis for calculating the tax advance. From the preferential 5 percent. The tax rate can be used on eligible income from qualifying intellectual property rights used to counter COVID-19.

The preferential tax rate in PIT can be used by those entrepreneurs who earn qualified intellectual property rights (IP) obtained as part of their research and development (R&D) activities.

These provisions also apple when the taxpayer does not have a qualified intellectual property right or the expectation of obtaining a qualified right, provided that an application for such protection is submitted or submitted to the competent authority within 6 months - counting from the end of the month, for which he used 5 percent when calculating the tax advance tax rate.

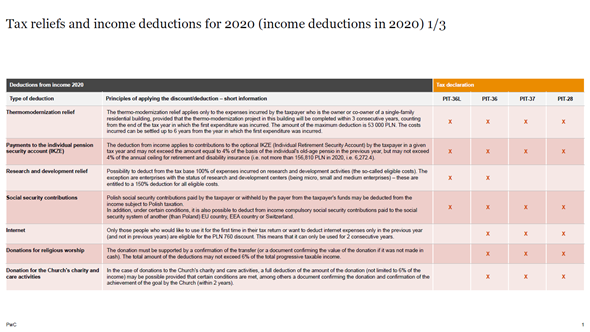

Selected deductions in 2020 from PIT income (click on the picture to enlarge)